You can withdraw cash anywhere and anytime in India with Manipur Rural Bank ATM cum RuPay debit card. Every saving account holders can avail MRB ATM cum RuPay debit card.

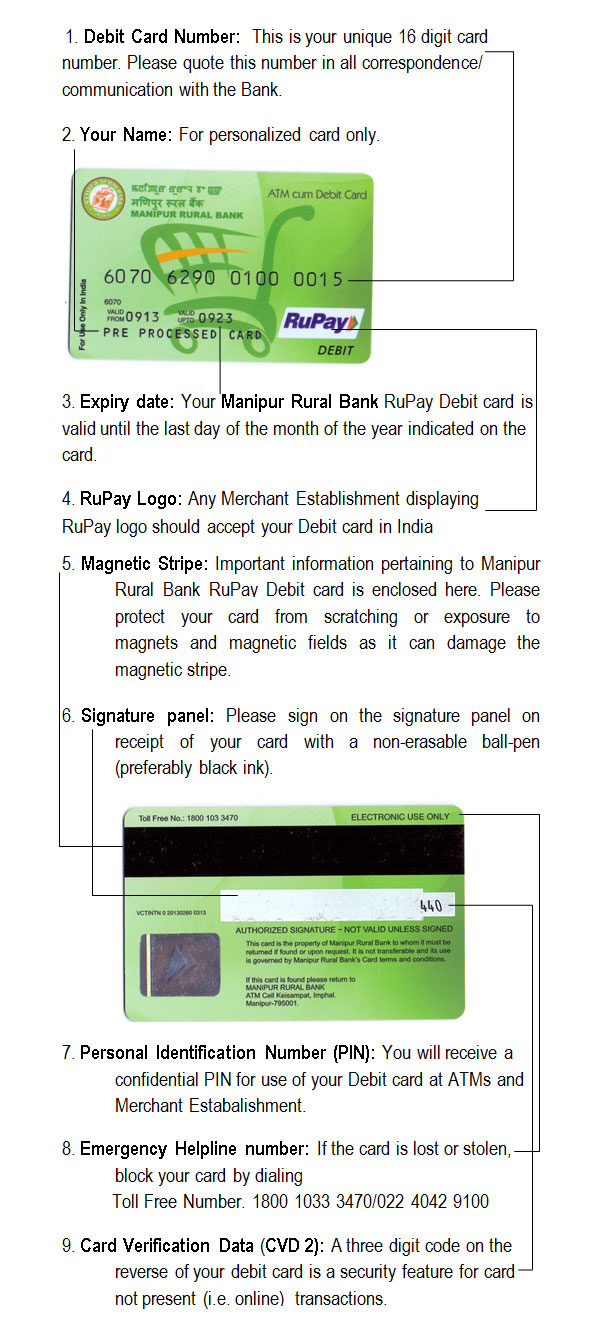

It’s our privilege to extend you a very warm welcome to the exclusive world of Manipur Rural Bank RuPay Debit Card. We are enclosing the Debit Card for your usage.

The card can be used not only at Manipur Rural Bank‘s ATMs, but also at ATMs of other Banks in the NFS network. The card can also be used at any Merchant Establishment displaying RuPay Logo.

Kindly go through the Card Usage Guide and the Terms & Conditions document carefully before using the card. For your security, we request you to sign on the signature panel on the reverse of the Card immediately, using a non-erasable ball-point pen.

Manipur Rural Bank RuPay ATM cum Debit Card Daily cash withdrawal limit Rs. 25,000

Manipur Rural Bank RuPay ATM cum Debit Card Daily POS limit Rs. 25,000

MANIPUR RURAL BANK RuPAY ATM CUM DEBIT CARD USER’S MANUAL

Using your MANIPUR RURAL BANK RuPay Debit Card at Merchant Establishment:

Step1: Present your card to the merchant.

Step2: The merchant will swipe it at the POS terminal and enter the amount of purchase.

Step3: You will be presented the PIN pad, key in your PIN.

Step4: The terminal will process the transaction and charge slip will be printed.

Step5: Check the amount on the charge slip and sign on the merchant’s copy.

Step6: The merchant will return the customer’s copy of the charge slip and your card.

Know your MANIPUR RURAL BANK RuPay Debit card:

MANIPUR RURAL BANK

ATM Cell (Head Office)

KEISAMPAT, IMPHAL, P.O IMPHAL

DIST: IMPHAL WEST, 795001

Toll Free: 1800 1033 3470/022 4042 9100

H.O Phone No: 0385 2451590

Email : mrbatm[at]manipurruralbank[dot]co[dot]in or debitcardcare[at]manipurruralbank[dot]co[dot]in

You can withdraw cash anywhere and anytime in India with Manipur Rural Bank ATM cum RuPay debit card. Every saving account holders can avail MRB ATM cum RuPay debit card. Brief details of the Rupay debit cards as follows.

1. DEFINITIONS

a. Account/s means Cardholder’s savings and/or current/overdraft account designated by the Bank to be eligible account/s for operations through the use of the Card.

b. Account Statement means a statement of account or the passbook issued by the Bank to a Cardholder setting out the transactions carried out and balance in the Account as on a given date, and any other information the Bank may deem fit to include.

c. ATM means any Automated Teller Machine whether in India or overseas, whether of the Bank or of a specified Shared Network, at which, amongst others, the Cardholder can use his Card to access his funds in his Account held with the Bank.

d. The ‘Bank’ means Manipur Rural Bank, Keisampat, Imphal.

e. Card means Manipur Rural Bank RuPay Debit-cum-ATM Card.

f. Cardholder means a customer of the Bank to whom a Card has been issued and who is authorised to hold the Card.

g. Charge means a charge incurred by the Cardholder for purchase of goods or services on the Card or any other charge as may be included by the Bank from time to time.

h. Merchant Establishment (ME) means commercial establishments of any nature, wherever located, which honour the Card for transactions with them.

i. Merchant means any person who owns or manages or operates at Merchant establishment.

j. Personal Identification Number (PIN) is a four digit confidential number given to the Cardholder by the Bank, while issuing the card or later changed by him from time to time, which is used to identify the customer at an ATM or a POS terminal for putting through transactions.

k. POS Terminal means point of sale electronic terminal at ME in India capable of processing transactions and at which, amongst others, the Cardholder can use his card to access his funds in his Account held with the Bank to make purchases.

l. Primary Account means the first account in the Accounts Particulars in the application for a card for the purpose of card operations.

m. Shared Network means RUPAY CARD networks, or any other networks like NFS or any other Bank’s private network called by any name.

m. Transaction means any instruction given by a cardholder by using his card directly or indirectly, to the Bank to effect some action on the account.

n. RUPAY regulations means regulations issued by RuPay to its franchisee/member banks.

Please visit the Branch/ Website (www.manipurruralbank.in) for eligibility towards issuance of debit card.

2. VALIDITY

The Card is valid for use at ATMs of the Bank, approved ATMs of RuPay displaying the logo. The cards can also be used at POS terminals in India displaying RuPay Logo. However, the Card is not valid for payment in foreign exchange. The Card is valid up to the last working day of the month and the year indicated on the Card.

3. PERSONAL IDENTIFICATION NUMBER (PIN)

To enable the Cardholder to use the Card, a Personal Identification Number (PIN) will initially be issued to him by the Bank, The Cardholder shall ensure that the PIN is received by him in a sealed mailer. The Cardholder should immediately upon receipt of the PIN, change the same to the PIN of his choice by using the card at an ATM of the Bank. The changed PIN should be used by the Cardholder for all his future transactions till he changes the PIN again. Under any circumstances, the Cardholder should not disclose his PIN to anyone including a joint account holder and the Bank. The cardholder shall be solely responsible for the consequences arising out of disclosure of his PIN. Any instructions given by means of the card and the PIN, whether in conjunction or independently shall be deemed to be instructions given by the Cardholder, and the Bank shall be entitled to assume that those instructions are given by the Cardholder.

4. LOST OR STOLEN CARDS

a. If a Card is lost or stolen, the Cardholder must file a report with the local police and send a copy of the same to the Bank. The Cardholder will be liable for all charges incurred on the Card until the Card is hot-listed / cancelled. The Cardholder may report a Card loss over the telephone (toll-free number – 1800-103-3470) or by way of written communication by failing to his branch of the Bank or designated agency. The Bank upon adequate verification will temporarily suspend the Card, and will subsequently hot-list / cancel the card during working hours on a working day following the receipt of such intimation.

b. Once a Card is reported lost or stolen and is subsequently found, the same should be promptly cut in half and returned to the Bank to prevent any misuse. The cardholder shall take all steps to keep the card safely. The Cardholder has to suffer and bear the financial liability on the lost or stolen Card. Provided that the Cardholder has complied with the terms and conditions in all respects, a replacement card may be issued at the sole discretion of the Bank.

5. SURRENDER/REPLACEMENT OF CARD

Card damaged/broken while in use or otherwise or lost, however, will be replaced at a cost decided by the Bank from time to time. A replacement Card may, however, be issued at the Bank’s discretion against (i) a fresh application and (ii) a suitable indemnity in case of a lost Card or surrender of the Card if it is broken/damaged as the case may be. The Card issued to the Cardholder shall remain the property of the Bank and will be surrendered to the Bank, on request or in the event the card is no longer required by the cardholder. The Cardholder shall return the Card to the Bank for cancellation in the event the services are no longer required by the Cardholder or if the services are withdrawn by the Bank for any reason whatsoever. The Bank, may, in its absolute discretion issue a replacement Card, with a new PIN for any lost or stolen Card or a new PIN on the existing Card, or issue a renewal Card with a new PIN on the same terms and conditions or such other terms and conditions as the Bank may deem fit, subject to the foregoing provisions, the Cardholder will not hold the Bank liable in case of improper/fraudulent/unauthorized/erroneous use of the Card or through a duplicate card and/or the PIN in the event of the Card falling in the hands of or through the PIN coming to the knowledge of any third party.

6. CARDHOLDER’S RIGHT TO SURRENDER CARD

a. The Cardholder may discontinue this facility any time by written notice to the Bank and returning the Card to the Bank cut into two pieces diagonally. The Cardholder shall be liable for all charges incurred on the card. The Bank shall be entitled to discontinue this facility at any time by cancelling the Card with or without assigning any reason whatsoever.

b.If the Cardholder desires to close the Primary Account or even otherwise decides to terminate the use of the Card facility, he shall give the Bank not less than TWO working days’ notice in writing and forthwith surrender the Card to the Bank at the Card-Issuing Branch and obtain a valid receipt thereof.

7. BANK’S RIGHT TO REFUSE RENEWAL/TERMINATE CARD

The Bank may in its absolute discretion renew a card upon payment of prescribed charges. The Bank shall be entitled in its absolute discretion to refuse to issue/renew a Card to any Cardholder or withdraw the Card and’ or services thereby provided at any time. The Bank shall terminate the Card facility with immediate effect upon the occurrence of any of the following events:

a. Failure to adhere to or comply with the terms and conditions herein set forth and also the terms and conditions that are applicable to cardholder’s accounts with the Bank;

b. In the event of default under any agreement or commitment (contingent or otherwise) entered into with the Bank;

c. The Cardholder becoming the subject of any bankruptcy, insolvency proceedings or proceedings of similar nature;

d. Demise of the Cardholder;

e. Reported lunacy/insanity/unsound mind of the Cardholder;

f. If the Bank deems that the facility is being misused/improperly used in any way;

g. If any adverse report is received from any of the Banks/Branches in the network; The Card shall be made non-operational in case of Primary account being made inoperative by the Bank. Notwithstanding termination of the ATM Card facility, the transactions already processed but reported to the Cardholder’s branch after the termination shall be put through the Cardholder’s Account.

8. TERMS OF USAGE

a. The Card is not transferable and shall be used only by the Cardholder.

b. The Cardholder shall at all times ensure that the Card is kept at a safe place, and shall under no circumstances whatsoever allow the Card to be used by any other individual. The Cardholder will sign on the reverse of the card in the signature panel immediately upon receipt of the card from the Bank.

c. The Card is the property of the Bank and must be returned to an authorized person of the Bank on request or in the event of Cardholder no longer requiring the services. The Cardholder shall ensure that the identity of the authorized person of the Bank is established before handing over his Card.

d. The cardholder will be responsible for all facilities granted by the Bank in respect of the Card and for all related charges.

e. The type of Transaction offered on Shared Network ATMs may differ from those offered on the Bank’s own network. The Bank will only support cash withdrawal and balance enquiry transactions at the ATMs belonging to Shared Networks. The Bank reserves the right to change the types of transactions supported without any notice to the Cardholder.

9. MULTIPLE ACCOUNTS/ JOINT ACCOUNTS

a. The Cardholder agrees that in case he has multiple accounts with the Bank, the Bank shall have the right to decide the number of accounts, which will have the Card facility on them.

b. Transfer of primary account or any change in operational mode thereof will not be allowed unless the Card is surrendered and dues, if any, against it, are paid.

c. The Bank will debit the Accounts linked to the Card for the value of all purchases of goods or services, cash, fees, charges and payments payable by the use of the Card.

d. The Cardholder shall maintain, at all times, in his Primary Account at the Bank the minimum deposit amount as applicable from time to time during the validity period of the Card, and the Bank may, at its discretion levy such penal or service charges as per Bank’s rules from time to time or withdraw the Card facility,

if at any time, the amount of deposit falls or has fallen below the minimum amount of deposit as aforesaid, without giving any further notice to the Cardholder and/or without incurring any liability or responsibility whatsoever, by reason of such withdrawal.

e. The Cardholder or such cardholder who is a Joint account holder permitted to operate upon the joint account singly authorizes the Bank to debit the account/s with the amount withdrawn and/or transfers effected by the use of the Card, as per Bank’s records. The Bank’s record for transaction processed by the ATM machine / POS terminal / online transactions shall be binding on all the account holders jointly and each severally. All fees/charges related to the Card, as determined by the Bank, from time to time, will be recovered by debiting any of the Cardholder’s accounts. In case any of the joint account holders desire to give stop payment/transaction instructions, in respect of operations of the Card, at least seven days clear prior notice, in writing, will have to be given to the Bank, so as to enable the Bank to inform all Banks/ATM centres participating in the Network and take steps in its discretion to carry out the instructions.

10. STATEMENTS AND RECORDS

a.The Cardholder shall accept the Bank’s record of the transactions as conclusive and binding for all purposes. The printed output that is produced at the time of operation of the ATMs is the record of the Cardholder’s operations on the ATM and shall not be construed as the Bank’s record for this purpose. Transactions conducted after the normal business hours, of the bank/branches, would be reflected in the Bank statement of accounts on the next business day. For the purpose of levy of charges/interest etc., the actual date of transactions will be reckoned

b. The Cardholder should inform the Bank in writing within 15 days from the date of transaction if any irregularities or discrepancies exist in the Transactions/particulars of the Account. If the Bank does not receive any information to the contrary within 15 days, the Bank would assume that the Account Statement and the Transactions recorded therein are correct.

c. To ensure the Cardholder’s interest, the Bank may record on camera or on videotape, at its own discretion, the access to and the presence of any person while availing the use of the Card facilities. All records maintained by the Bank, in electronic or documentary form, of the instructions of the Cardholder and such other details, and all camera/video recording made as

mentioned above shall, as against the Cardholder, be deemed to be conclusive evidence of such instructions and such other details.

11. ATM USAGE

a. At no time shall the Cardholder use or attempt to use the Card, (a) for withdrawal or transfer (within permitted limit) unless there are sufficient funds in the Accounts and/or (b) for withdrawal or transfer with the intention to default payment of his cheque/s issued to other parties. In case an ATM / POS terminal / online transaction debit and clearing cheque are presented simultaneously in an account, the ATM / POS terminal / online transaction debit “would be accorded first priority over the cheque and in the event of insufficient funds after ATM / POS terminal / online transaction debit, the cheque would be returned by the Bank. It will be the responsibility of the account holder to maintain sufficient funds for a cheque and other transactions.

b. The Card is operable with the help of the confidential PIN at ATM locations. All Transactions conducted with the use of the PIN will be the Cardholder’s responsibility and he will abide by the record of the transaction as generated. When the Cardholder completes a transaction through an ATM, he can opt to receive a printed transaction record. The amount of available funds is shown on this ATM receipt when he uses his card.

c. The Cardholder should retain the record of Transactions generated by the ATM with him.

d. The Cardholder agrees that he will be allowed to withdraw cash up to a maximum of Rs.25000.00 subject to a single transaction of not more than Rs. 15000.00 and make purchases up to a maximum of Rs. 25000.00 per day (aggregating to Rs. 50000.00 per day) subject to availability of clear balance in the Account (s) or any such maximum withdrawal/purchase limits decided by the Bank from time to time. Any attempt to violate these limits would lead to withdrawing of the his-Card facility. The Cardholder agrees not to attempt to withdraw/purchase using the Card unless sufficient funds are available in the Account. The onus of ensuring adequate Account balance is entirely on the Cardholder.

12. MERCHANT LOCATION USAGE

a. The Card is acceptable at all MEs in India which display the logos of the Bank/RUPAY CARD and which have a POS terminal. The Card is for electronic use only. The Cardholder must key in pin and sign a Sales Slip whenever the Card is used at a Merchant Establishment and should retain his copy. The Bank at an additional charge may furnish copies of the Sales Slip as per RUPAY CARD rules upon cardholders request within 30 days of the transaction date. Any Sales Slip not personally signed by the Cardholder, but which can be proved as being authorized by the Cardholder, will be his liability. The amount of

the transaction is debited from the Primary Account linked to the Card immediately. The Card is operable with the help of the Cardholder’s signature and the PIN at POS terminals installed at Merchant locations depending on the functionality of the POS terminal.”

b. The Bank will not accept responsibility for any dealings, the Cardholder may have with the merchant including but not limited to the supply of goods and services. Should the cardholder have any complaints concerning any Merchant Establishment, the matter should be resolved by the Cardholder with the Merchant Establishment and failure to do so will not relieve him from any obligations to the Bank. However, the Cardholder should notify the Bank of this complaint immediately for action by the Bank as per RUPAY CARD rules.

c. The Bank accepts no responsibility for any surcharge levied by any Merchant Establishment and debited to the Cardholder’s Account with the Transaction amount.

d. Any charge or other payment requisition received from an ME by the Bank for payment shall be conclusive proof that the charge recorded on such requisition was properly incurred of the ME for the amount and by the Cardholder using the Card referred to in that charge or other requisition except where the Card has been lost or stolen and such loss was duly reported to the police and intimated to the Bank in terms of clause 6 above.

e. If any Cardholder claims that the card was used fraudulently, the burden of proof of fraud lies with the Cardholder. The Bank does not undertake any responsibility for any loss if incurred by the cardholder on account of such fraudulent usage.

f. In case a cardholder wishes to cancel a completed transaction due to an error or on account of merchandise return, the earlier sales receipt must be cancelled by the Merchant, and a copy of the receipt for cancellation transaction must be retained by the Cardholder. Reversal/debits due to such Transactions will be processed manually. It is necessary for the cardholder to produce the sales receipts for the cancellation transaction for effecting the reversals.

13. EXCLUSION FROM LIABILITY

a. Consideration of the Bank providing the Cardholder with the facility of the Card, the Cardholder hereby agrees to indemnify and keep the Bank indemnified from and against all actions, claims, demands,

proceedings, losses, damages, personal inquiry costs charges and expenses which the Bank may at any time incur, sustain, suffer or be put to as a consequence of or by reason of or arising out of providing the Cardholder with the said facility of the Card or by reason of the Bank’s acting in good faith and taking or refusing to take or omitting to take action on the Cardholders. Instructions and in particular arising directly or indirectly out of the negligence, mistake or misconduct of the Cardholder; breach or non-compliance of the rules, terms and conditions relating to the Card and the Account and/or fraud or dishonesty relating to any Transaction by the Cardholder or/any unauthorised user.

b. The Cardholder agrees to indemnify the Bank for any machine/mechanical error/failure. The Cardholder shall also indemnify the Bank fully against any loss -on account of misplacement by the courier and or loss-in-transit of the Card/PIN.

c. Without prejudice to the foregoing, the Bank shall be under no liability whatsoever to the Cardholder in respect of any loss or damage arising directly or indirectly out of any defect in the quality of goods or services supplied by MEs.

* The refusal of any person to honour or accept a Card.

* The malfunction of any computer terminal, ATM or POS terminal.

* Effecting Transaction instructions other than by a Cardholder.

* Handing over of the Card by the Cardholder to anybody other than the designated employees of the Bank at the Bank’s premises.

* The exercise by the Bank of its right to demand and procure the surrender of the Card prior to the expiry date printed on its face, whether such demand and surrender is made and/or procured by the Bank or any person or computer terminal, ATM or POS terminals.

* The exercise by the Bank of its right to terminate any Card.

* Any injury to the credit, character and reputation of the Cardholder alleged to have been caused by the repossession of the Card and/or, any request for its return or the refusal of any Merchant Establishment to honour or accept the Card.

* Any misstatement, misrepresentation, error or omission in any detail disclosed by the Bank.

d. Except as otherwise required by law, if the Bank receives any process summons, order, injunction, execution decree, lien, information or notice which the Bank in good faith believes calls into question the Cardholder’s ability, or the ability of someone purporting to be authorized by the Cardholder, to transact on the Card, the liability to the Cardholder or such other person, decline to allow the Cardholder to obtain any portion of his funds or may pay such funds over to an appropriate authority and take any other steps required by applicable law.

e. The Bank reserves the right to recover from the Cardholder’s Account a reasonable service charge and any expenses it incurs, including but not limited to reasonable legal fees, due to legal action involving the Cardholder’s Card.

f. In case the account gets overdrawn due to any reason, the Cardholder should provide enough funds to bring it in credit. For every occasion when the account is overdrawn, a flat fee is levied, in addition to the interest, The flat fee and interest shall be recovered at the rate determined by the Bank from time to time.

g. In the event of an Account being overdrawn due to Card Transaction, the Bank reserves the right to set off miss amount against any credit lying in any of the Cardholder’s other accounts held singly or jointly without giving any notice, wherever applicable.

h. Nothing in these terms and conditions shall affect the Bank’s right of set-off, transfer and appropriation of monies pursuant to any other agreement from time to time subsisting between the Bank and Cardholder.

i. The details of applicable fees and charges are as below:

Fee for using ATMs: Table 1

| Daily Cash Limit at ATM (Rs) | Total no. of free Transactions/Months | Charge Applicable beyond Free Limit (Rs) | |

|---|---|---|---|

| MRB & UBI ATM | 25000/Day | No limit | Nil |

| At other ATMs (for saving Ac. Customers) | Max. 10000/Transaction | 5 | A. Cash Withdrawal: 20/Transaction B. Non Financial: 8/Transaction |

| At other ATMs (for other than saving Ac. Customers) | Max 10000/Transaction | Nil | A. Cash Withdrawal: 20/Transaction B. Non Financial: 8/Transaction |

Daily Transaction Limit of Debit Card: Table 2

| Sl | Activity | Limit in |

|---|---|---|

| 1 | Daily Cash Limit at ATMs | 25000 |

| 2 | Daily PoS/Online Transaction Limit | 25000 |

Debit Card Charge: Table 3

| Sl | Activity | Charge in |

|---|---|---|

| 1 | Issuance of Primary Card | Free |

| 2 | Issuance of Add on Card | 100+ Service Tax |

| 3 | Annual Charge | 1st year-Free 2nd year onwards 100+ Service Tax |

| 4 | Duplicate Card | 150+Service Tax |

| 5 | Re-PIN | 50+Service Tax |

| 6 | Charge Slip retrieval charges | 300+Service Tax Per charge slip |

14. DISPUTES

a. The Bank accepts no responsibility for refusal by any Merchant Establishment to accept and/or honour the Card. In case of dispute pertaining to a Transaction with a Merchant Establishment, a sales slip with the signature of the Cardholder together with the Card number noted thereon shall be conclusive evidence as between the Bank and the Cardholder as to the extent of liability incurred by the Cardholder and the Bank shall not be required to ensure that the Cardholder has duly received the goods purchased / to be purchased or has duly received the service availed/to be availed to the Cardholder’s satisfaction.

b. A sales slip with the signature of the cardholder together with the card number “noted thereon shall be conclusive evidence, as between the Bank and the cardholder, as to the extent of liability incurred by the cardholder The Bank shall make bonafide and reasonable efforts to resolving an aggrieved cardholder’s disagreement with the charge indicated in the statement within two months of receipt of the notice of disagreement.

c. Any dispute in respect of a Shared Network ATM Transaction will be resolved as per regulations of the respective network. The Bank does not accept responsibility for any transactions the Cardholder may have on the Shared Networks. Should the Cardholder have any complaints concerning any shared Network ATM, the matter should be resolved by the Cardholder with the Shared Network, and failure to do so will not relieve him from any obligations to the Bank. However, the Cardholder should notify the Bank of the complaint immediately.

15. MISCELLANEOUS

a. The terms and conditions for use of the Card are as specified in this document and as amended by the Bank from time to time. The Cardholder shall be deemed to have unconditionally agreed to and accepted these terms and conditions by signing the Card application form or acknowledging receipt of the Card by signing on the reverse of the card, or by performing a transaction with the Card

or by requesting activation of the Card to the Bank or after 10 days have elapsed since the Card was dispatched to its address on record, relieving him from any obligations to the Bank. However, the Cardholder should notify the Bank of the complaint immediately.

b. These terms and conditions will be in addition to and not in derogation of the terms and conditions relating to any account of the Cardholder. The Bank may also make changes in the terms and conditions without notice, if it is considered that the changes are necessary to maintain or restore the security of the electronic system or equipment used for the Card Transactions and/or for any other reason whatsoever and the same shall be binding on the cardholder.

c. The Bank will not be responsible if the ATMs failed to function due to breakdown of power, communication line, and mechanical failure or for any reasons which are beyond its control.

16. NOTIFICATION OF CHANGES

a. The Bank has the absolute discretion to withdraw the Card and/or the services thereby provided or amend or supplement any of the above terms and condition at any time without prior notice to the Cardholder.

b. All authorizations and power conferred on the Bank are irrevocable.

17. GOVERNING LAW

a. The usage of the Card and the terms and conditions will be governed by the laws of India.

b. The Cardholder undertakes to comply with the applicable laws and procedures while availing of and utilizing the Card.

c. All disputes are subject to the jurisdiction of the competent courts in Kolkata.

18. FORCE MAJEURE:

The Bank will not be responsible nor shall it be liable to indemnify the Cardholder in the event of any loss or damage suffered by the Cardholder due to any cause or reason beyond the control of the Bank.